Most conversations about Azure start with regions, VNets, and landing zones. Serious financial organisations hit a different wall much earlier.

The questions that actually stop progress:

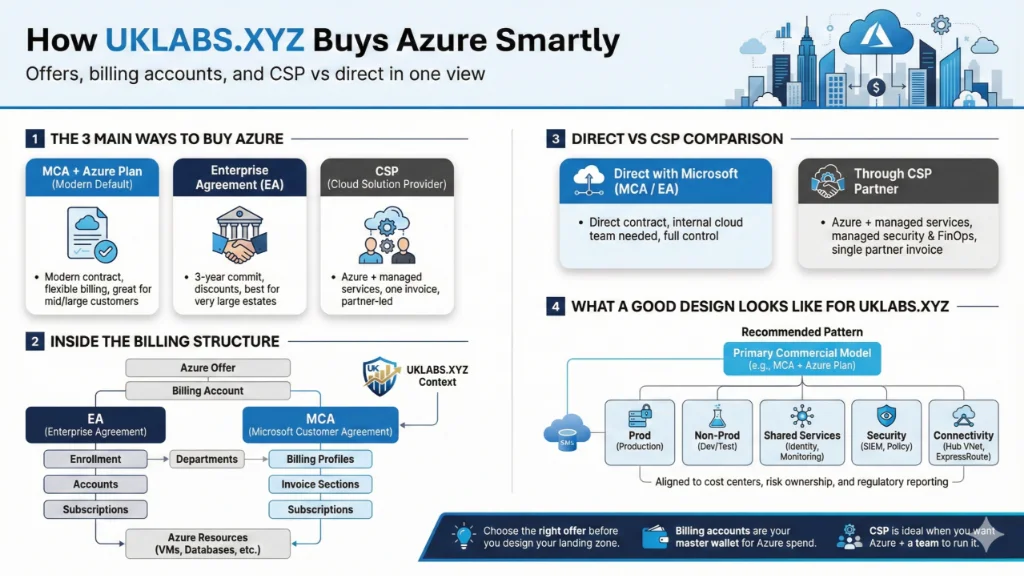

- "Should we be on EA, MCA, or CSP?"

- "What is an Azure offer vs a billing account?"

- "If we change commercial model, what happens to our subscriptions?"

If these are fuzzy, every TCO, migration plan, and governance model sits on sand.

In this article, I use a fictional financial organisation, UKLABS.XYZ, to explain how modern Azure offers actually work and how I would steer leadership through the choices.

1. The Setup: UKLABS.XYZ Wants to Move into "Azure City"

UKLABS.XYZ is a financial firm with:

- Trading and treasury systems

- Risk, regulatory reporting, and analytics platforms

- Strict governance, audits, and cost scrutiny

They want to move a portfolio of workloads into Azure.

Before we talk about landing zones or migration waves, leadership needs three decisions:

- Which Azure offer are we buying under?

- What billing account structure will finance and governance live with?

- Are we buying directly from Microsoft or through a CSP partner?

Critical: Get these wrong and you spend months fixing invoices and contracts instead of modernising applications.

2. Azure Offers: The Real Entry Doors for UKLABS.XYZ

Think of an Azure offer as the commercial deal type your subscriptions sit on. For a financial organisation like UKLABS.XYZ, there are three serious doors and a few supporting ones.

2.1 Microsoft Customer Agreement (MCA) + Azure Plan – Modern Default

What it is

- A modern contract called the Microsoft Customer Agreement

- Under it, you get an Azure Plan, which defines pricing and terms for Azure services

Why it matters to UKLABS.XYZ

- Modern, cleaner commercial model

- Works well for mid-to-large customers that do not need a full Enterprise Agreement

- Easier to align with future evolution of Microsoft commerce

My recommendation: If UKLABS.XYZ is not already deep in EA, MCA + Azure Plan is usually the first option I put on the table.

2.2 Enterprise Agreement (EA) – The Classic "Big Bank" Contract

What it is

- A 3-year Enterprise Agreement with a committed spend and negotiated discounts

- An EA billing account with an enrollment that structures departments, accounts, and subscriptions

Why it matters to UKLABS.XYZ

- Still the standard model for large enterprises with big Microsoft estates

- Good fit when you have significant Azure + M365 + Dynamics spend

- Provides volume discounts and predictable pricing

My take: EA is not dead. But Microsoft is gradually steering appropriate customers to MCA at renewal, so I treat EA as a fit for truly large, integrated relationships.

2.3 CSP – Buying Azure Through a Partner

What it is

- UKLABS.XYZ buys Azure from a partner, not directly from Microsoft

- Microsoft invoices the CSP. The CSP invoices UKLABS.XYZ

- Modern CSP commerce also uses Azure Plan behind the scenes

Why a financial org would choose CSP

Leadership does this when they want more than raw Azure:

- Managed cloud operations (monitoring, backup, patching, DR)

- Security operations and governance support

- FinOps advisory and continuous cost optimisation

- One combined invoice for Azure and services, often in local currency

In plain terms: For UKLABS.XYZ, CSP makes sense if they want a strong partner accountable end-to-end for platform operations, not just consulting.

2.4 Other Offers Leadership Should Be Aware Of

There are a few more categories that matter in design and assessment:

- Pay-As-You-Go (classic PAYG): Simple, billed directly by Microsoft at public rates. Useful for small labs and PoCs, but not for serious financial estates

- Dev/Test and Visual Studio offers: Discounted non-production offers. Good for dev, QA, and sandboxes when used correctly

- Free, students, sponsorship: Free Trial, Azure for Students, etc. Useful for training and PoCs, not for production

- Azure in Open Licensing (legacy): From 1 January 2022, commercial customers cannot buy or renew through Open License. Classify as legacy and plan migration to MCA or CSP

3. Billing Accounts, Profiles, Enrollments, and Subscriptions

Once UKLABS.XYZ chooses an offer, Azure creates a billing account.

3.1 Billing Account – The Master Wallet

A billing account:

- Is created when you sign up for Azure

- Holds invoices, payment methods, and cost views

- Can represent EA, MCA, or personal/commercial contracts

For UKLABS.XYZ, you might see:

- An EA billing account (if they already have an EA)

- An MCA billing account for newer spend

- CSP billing scopes in the partner's tenant

This is where CFO, procurement, and FinOps teams care the most.

3.2 EA Structure: Enrollment, Departments, Accounts, Subscriptions

Under EA, the structure is:

- Enterprise enrollment – represents the overall relationship

- Departments – big organisational units (Retail, Markets, Risk, IT Shared)

- Enrollment accounts – logical owners that can create subscriptions

- Subscriptions – where workloads run

In practice, when I assess a financial estate under EA, I map:

- Which departments map to which cost centres

- Which enrollment accounts are effectively "service owners"

- How subscriptions align to applications and environments

3.3 MCA Structure: Billing Profiles, Invoice Sections, Subscriptions

Under MCA and Azure Plan:

- Billing account

- Billing profiles – usually map to major financial or organisational groupings

- Invoice sections – sub-splits inside a billing profile

- Subscriptions – linked to invoice sections

For UKLABS.XYZ I would design, for example:

- Billing profile "UKLABS.XYZ – Core Banking & Payments"

- Billing profile "UKLABS.XYZ – Risk & Analytics"

- Billing profile "UKLABS.XYZ – Shared Services & Platform"

Then invoice sections and subscriptions under each, aligned to cost centres and regulatory reporting needs.

4. Direct vs CSP for a Financial Organisation: How I Frame It

When I sit with financial leadership, I simplify the decision like this:

Option A – Direct with Microsoft (MCA or EA)

Choose this if:

- You have or will build a strong internal cloud platform and operations team

- You want direct commercial relationship and negotiation with Microsoft

- You are comfortable owning FinOps, security operations, and governance internally, possibly with targeted consulting help

My recommendation: MCA is usually my "modern default" recommendation. EA stays on the table for genuinely large, integrated, multi-year relationships.

Option B – CSP Through a Partner

Choose this if:

- You want to bundle Azure consumption with managed services

- You want a single accountable provider for platform operations

- You prefer a consolidated invoice, often in local currency, with local support and governance

Important: CSP does not remove Microsoft from the relationship, but it changes where operational and commercial accountability sits.

In practice, many organisations end up with a hybrid reality:

- Some subscriptions under direct MCA/EA

- Some under CSP for specific workloads or regions

The important part is to design this deliberately, not accidentally.

5. A Simple Playbook for UKLABS.XYZ Leadership

If I were advising UKLABS.XYZ at C-level, my recommendation would look like this:

- Pick the primary commercial model intentionally

- MCA for modern, flexible growth

- EA for large, integrated Microsoft relationships

- CSP when you want managed operations bundled

- Standardise the billing account design

- Map billing profiles/departments to cost centres

- Align invoice sections to regulatory reporting needs

- Rationalise legacy offers

- Identify and migrate away from Azure-in-Open, old PAYG, etc.

- Consolidate onto modern offers

- Tie subscriptions to the operating model, not just projects

- Subscriptions should map to applications and environments

- Not ad-hoc project requests

- Lock this into your landing zone and FinOps design

- Billing structure drives governance

- Make it part of your Azure foundation

Closing Thought

Most cloud stories focus on technical architecture. In real enterprise work, especially in financial services, the commercial and billing architecture is just as important.

By understanding Azure offers, billing accounts, and CSP vs direct at this level, you position yourself not as "the cloud person who knows SKUs," but as the architect who can talk to CFOs, CPOs, and regulators in their language and still land the right technical design.

This is exactly how I approach Azure migrations and landing zone programmes with financial clients: start with the doors into Azure City, then design everything else on top of that foundation.